media statement

chevron australia’s tax and royalties payments exceed A$12 billion

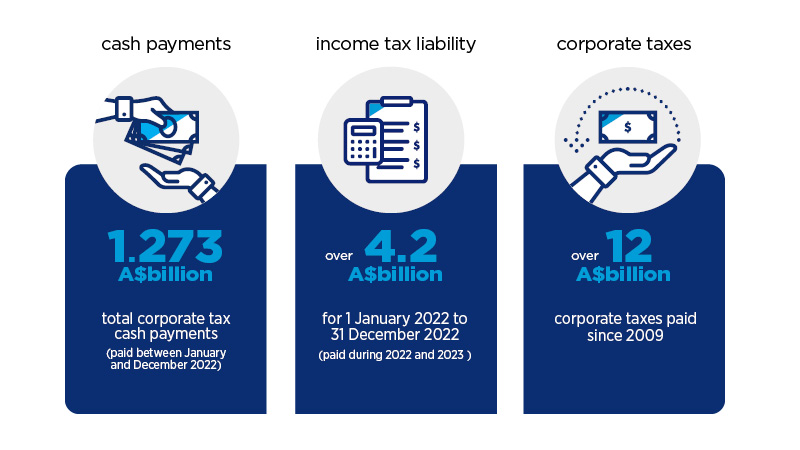

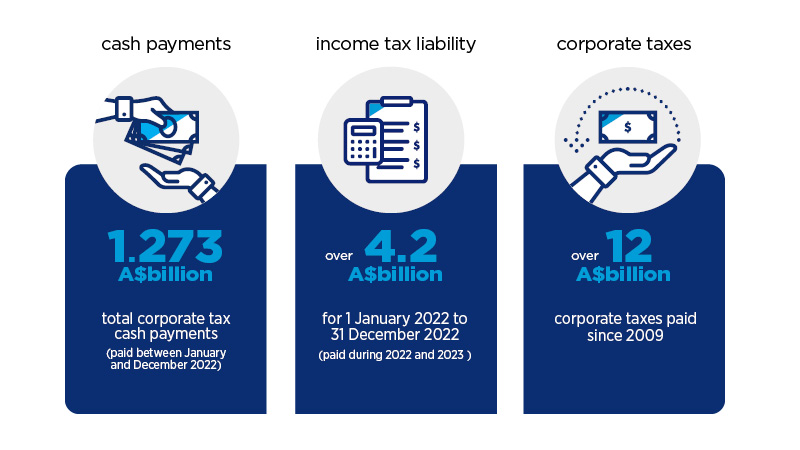

PERTH, Western Australia, 31 October 2023 – Chevron Australia’s tax and royalties payments now exceed A$12 billion since 2009 following an acceleration of company income tax payments over the past year.

Outlined in Chevron Australia’s 2022 Tax Transparency Report, corporate tax cash payments were more than A$1.2 billion in the 2022 calendar year which includes income tax, royalties, excise, interest withholding tax, payroll tax, fringe benefits tax and other withholding taxes.

Chevron Australia’s company income tax payment liability for the period 1 January to 31 December 2022 was $4.2 billion.

The majority of this liability for 2022 was paid in 2023.

Chevron Australia Managing Director Mark Hatfield said, “We’re pleased to confirm that Chevron Australia has paid more than A$12 billion in tax and royalty payments since 2009 – the year we reached final investment decision on the Gorgon Project – which includes A$4.2 billion in company income tax for the 2022 year alone.”

“It’s a significant milestone and one we’re proud of achieving after investing more than A$80 billion with our joint venture partners on the Gorgon and Wheatstone projects, which remain two of the country’s largest resource developments,” he said.

“It’s also a demonstration of how natural gas projects can significantly contribute to economic development and support government revenue while providing energy security for communities and industries in Australia and across the Asia Pacific region.”

Hatfield said Chevron Australia’s company tax payments had accelerated now that the projects had passed initial start-up phases and were in full production. Market conditions also increased company revenue over the period, which further supported tax receipts.

“While like most businesses we can’t predict the exact amount of tax we’ll pay in the future, we look forward to continuing our significant economic contribution to the Australian economy in many decades to come,” he said.

Other payments for the 2022 year included A$88 million for a temporary levy on Australian offshore petroleum production to recover the Commonwealth’s costs of decommissioning the oil fields and associated infrastructure abandoned by the insolvent operator of the Laminaria and Corallina oil fields.

Chevron Australia estimates it will pay approximately 22 percent of the decommissioning costs, despite having no interest or involvement in the oil fields or infrastructure.

If the Federal Government’s proposed Petroleum Resource Rent Tax changes become law, the new rules would apply from 1 July 2023 and Chevron Australia expects to pay PRRT in 2024 and future years.

Further information on Chevron Australia’s tax payments and economic contributions are outlined in the 2022 Chevron Australia Tax Transparency Report.

Chevron is one of the world's leading integrated energy companies and through its Australian subsidiaries, has been present in Australia for 70 years.

With the ingenuity and commitment of thousands of workers, Chevron Australia operates the Gorgon and Wheatstone natural gas facilities; manages its equal one-sixth interest in the North West Shelf Venture; operates Australia’s largest onshore oilfield on Barrow Island; is a significant investor in exploration; Chevron Australia Downstream delivers quality fuel and lubricant products via its Caltex and Puma Energy branded network of service stations across Australia.

Todd Cardy

Communications Advisor

Cam Van Ast

Media Advisor