media statement Chevron Australia acquires new exploration acreage and strengthens position offshore Western Australia

Perth, Western Australia, 05 October 2017 – Chevron Australia today announced its affiliate has successfully acquired exploration interests in three offshore blocks located in the Northern Carnarvon Basin off the Western Australia coast.

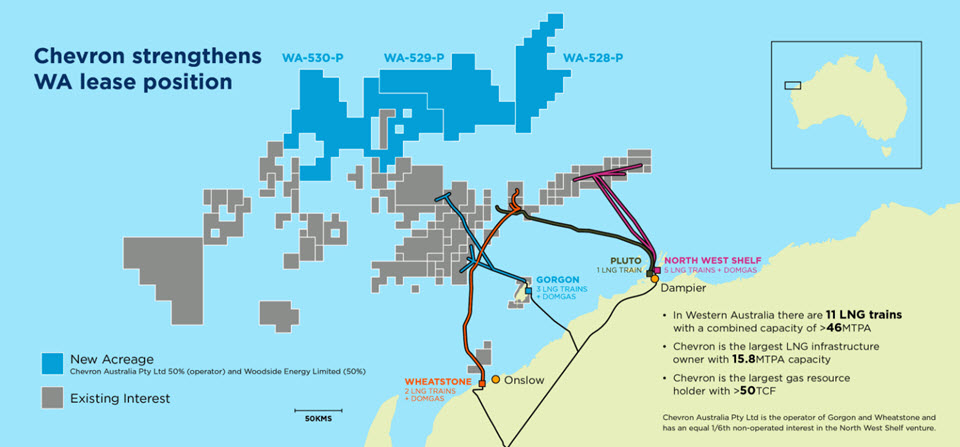

Chevron Australia Managing Director Nigel Hearne said this new acreage strengthens Chevron’s position in Australia’s premier hydrocarbon basin where there is an established network of production infrastructure, including the Chevron-operated Gorgon and Wheatstone Projects.

“Offshore Western Australia is a global focus area for Chevron and these new exploration blocks add to our already significant gas position as the largest resource holder and liquefaction owner.

“Chevron Australia has discovered around 50 trillion cubic feet of gas resources, and through collaboration we hope to commercialise this gas through the timely and efficient use of existing equity or third-party infrastructure. This supports our position as a leading operator and long-term supplier of clean and reliable natural gas to customers in Western Australia and the region,” said Hearne.

Blocks WA-528-P, WA-529-P and WA-530-P cover 23,170 square kilometres (km2) and are located approximately 220 km northwest of Dampier off the coast of Western Australia. Through its affiliate, Chevron will be operator with a 50 percent interest and Woodside Energy Limited will hold the remaining 50 percent interest.

Hearne added, “Partnership is going to be crucial for ongoing investment in Western Australia’s resource sector and to maximise the value of the available resources and infrastructure for the benefits of local jobs, companies and energy security.”

Chevron is one of the world's leading integrated energy companies and through its Australian subsidiaries, has been present in Australia for more than 60 years. With the ingenuity and commitment of thousands of workers, Chevron Australia operates the Gorgon and Wheatstone LNG and domestic gas projects; manages its equal one-sixth interest in the North West Shelf Venture; operates Australia’s largest onshore oilfield on Barrow Island; and is a significant investor in exploration.

NOTICE

CAUTIONARY STATEMENT RELEVANT TO FORWARD-LOOKING INFORMATION FOR THE PURPOSE OF “SAFE HARBOR” PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This press release contains forward-looking statements relating to Chevron’s operations that are based on management’s current expectations, estimates and projections about the petroleum, chemicals and other energy-related industries. Words or phrases such as “anticipates,” “expects,” “intends,” “plans,” “targets,” “forecasts,” “projects,” “believes,” “seeks,” “schedules,” “estimates,” “positions,” “pursues,” “may,” “could,” “should,” “budgets,” “outlook,” “focus,” “on schedule,” “on track,” “goals,” “objectives,” “strategies” and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond the company’s control and are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. The reader should not place undue reliance on these forward-looking statements, which speak only as of the date of this release. Unless legally required, Chevron undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Among the important factors that could cause actual results to differ materially from those in the forward-looking statements are: changing crude oil and natural gas prices; changing refining, marketing and chemicals margins; the company's ability to realize anticipated cost savings and expenditure reductions; actions of competitors or regulators; timing of exploration expenses; timing of crude oil liftings; the competitiveness of alternate-energy sources or product substitutes; technological developments; the results of operations and financial condition of the company's suppliers, vendors, partners and equity affiliates, particularly during extended periods of low prices for crude oil and natural gas; the inability or failure of the company’s joint-venture partners to fund their share of operations and development activities; the potential failure to achieve expected net production from existing and future crude oil and natural gas development projects; potential delays in the development, construction or start-up of planned projects; the potential disruption or interruption of the company’s operations due to war, accidents, political events, civil unrest, severe weather, cyber threats and terrorist acts, crude oil production quotas or other actions that might be imposed by the Organization of Petroleum Exporting Countries, or other natural or human causes beyond its control; changing economic, regulatory and political environments in the various countries in which the company operates; general domestic and international economic and political conditions; the potential liability for remedial actions or assessments under existing or future environmental regulations and litigation; significant operational, investment or product changes required by existing or future environmental statutes and regulations, including international agreements and national or regional legislation and regulatory measures to limit or reduce greenhouse gas emissions; the potential liability resulting from other pending or future litigation; the company’s future acquisition or disposition of assets or shares or the delay or failure of such transactions to close based on required closing conditions; the potential for gains and losses from asset dispositions or impairments; government-mandated sales, divestitures, recapitalizations, industry-specific taxes, changes in fiscal terms or restrictions on scope of company operations; foreign currency movements compared with the U.S. dollar; material reductions in corporate liquidity and access to debt markets; the effects of changed accounting rules under generally accepted accounting principles promulgated by rule-setting bodies; the company's ability to identify and mitigate the risks and hazards inherent in operating in the global energy industry; and the factors set forth under the heading “Risk Factors” on pages 20 through 22 of Chevron’s 2016 Annual Report on Form 10-K. Other unpredictable or unknown factors not discussed in this press release could also have material adverse effects on forward-looking statements.